Inside the Project: Million Dollar Split-Level in Bethesda, MD

This fix and flip project in Bethesda, Maryland started as a common 1960s split-level home with no significant updates since the 80s and in a near-hoarder home situation. The prime location and as-is condition of the property allowed our borrower to position themselves for a hefty profit margin. Our borrower secured a Fix and Flip Loan to finance both the purchase and renovation of this property, meaning they only needed to bring 10% of the total project cost, and the loan covered the rest. Let’s dive deeper into this project to see how our borrower executed it effectively.

Quick Project Stats:

Built: 1963

Home Type: Split-Level

As-Is:

- 4 bed

- 3 bath

- 1,884 sqft

As-Repaired:

- 5 bed

- 3 bath

- 2,736 sqft

As-Is Value: $860,000

Purchased: $785,000

Construction: $85,000

ARV: $1,150,000

Sold For: 1,280,000

Quick Neighborhood Stats:

Zipcode Median Sales Price: $1,250,000

Zipcode Median Days on Market: 28

Walk Score: Car-Dependent

School District:

- Seven Locks Elementary, 9/10

- Cabin John Middle School, 8/10

- Winston Churchill High, 8/10

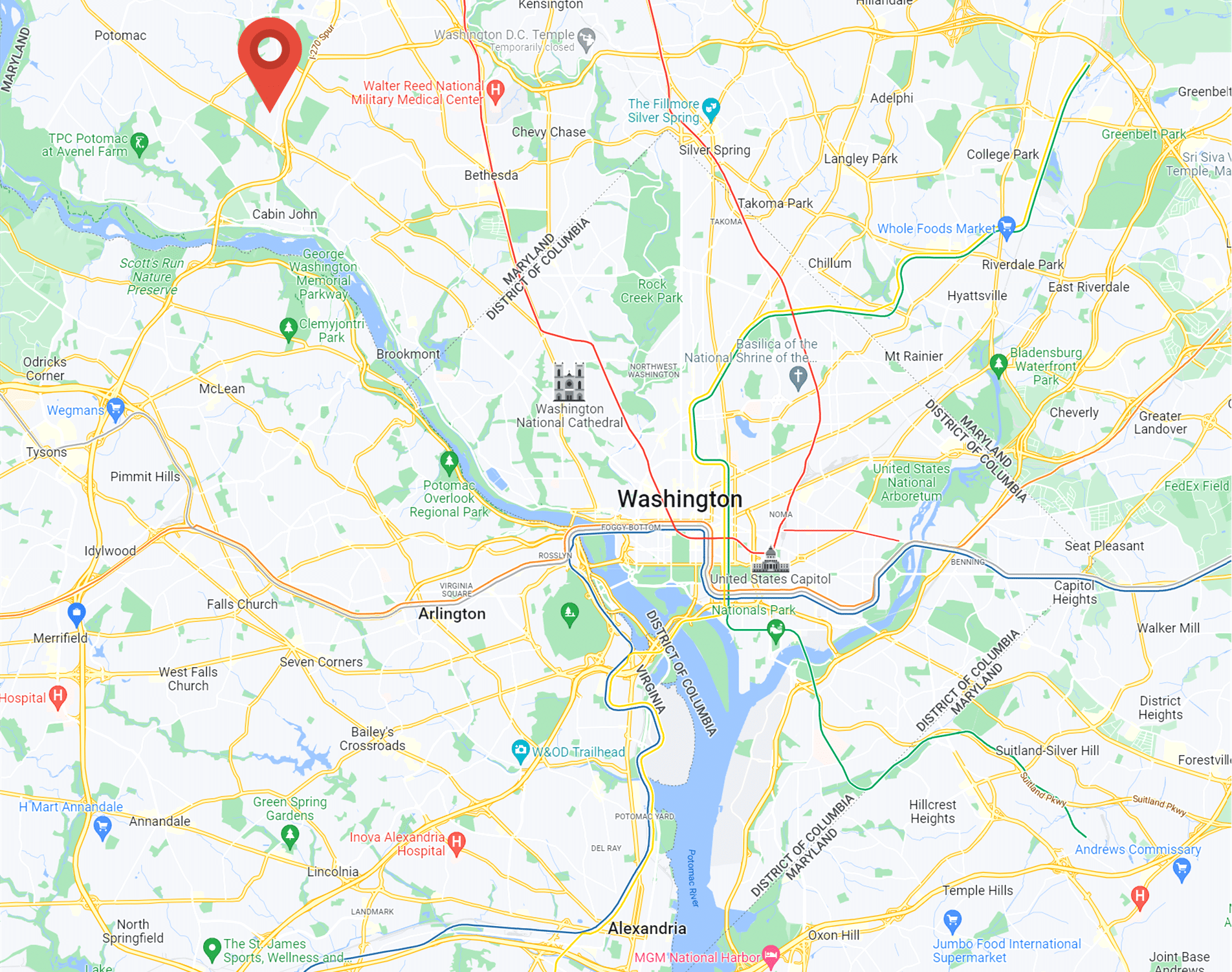

Location

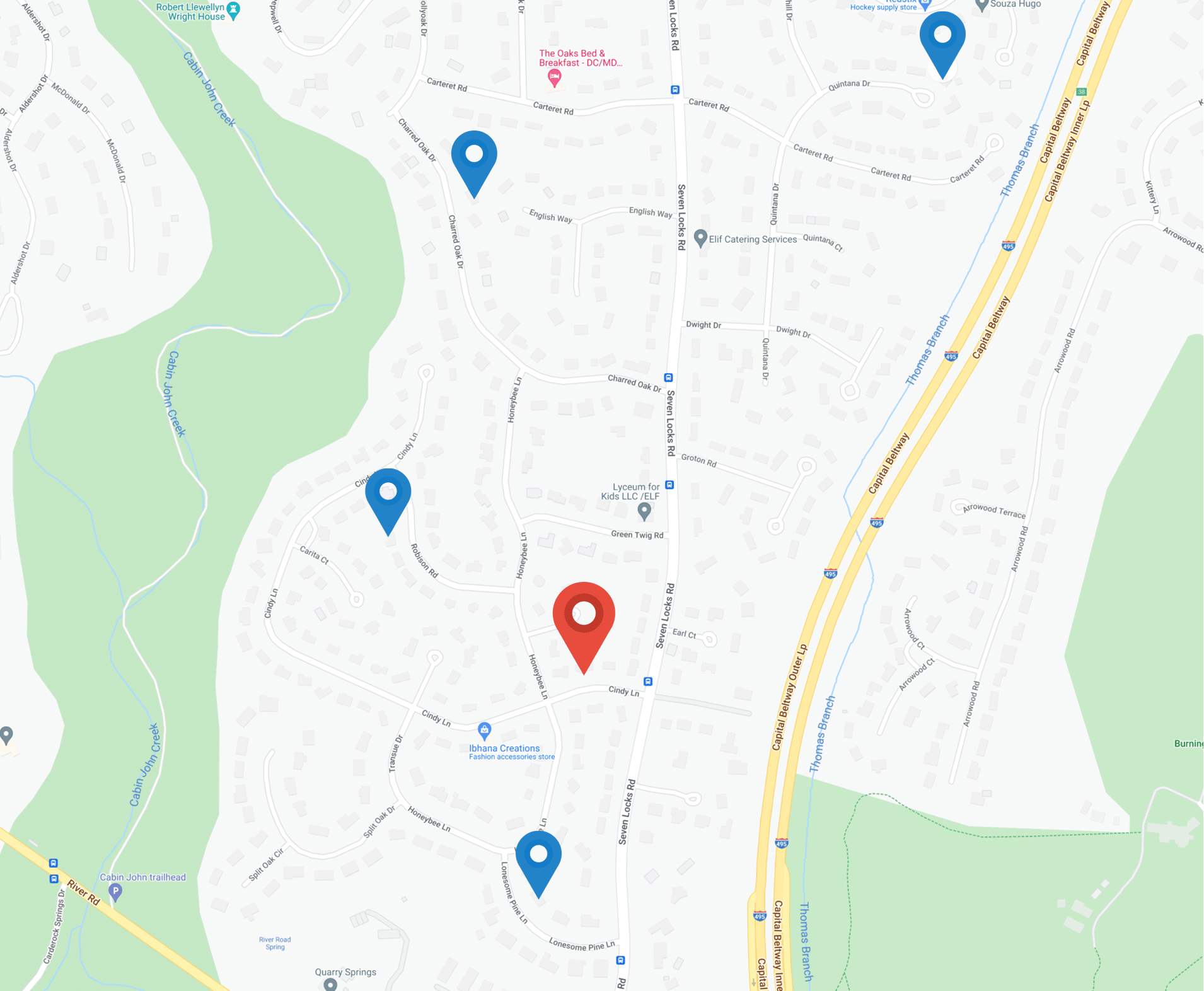

This property is located in Charred Oak Estates, a quiet residential neighborhood in Bethesda, Maryland. The neighborhood consists of single-family detached homes, mature trees, mostly 0.5+ acre lots, and is surrounded by golf courses and country clubs including well-renown Congressional Country Club which has hosted many major professional golf tournaments. Shopping and dining are about a 10-minute drive away, but this neighborhood has an outstanding location for commuting into DC and Northern VA, as it is located just off the Capitol Beltway. Bethesda proper, only about a 15 min drive east, boasts plenty of major employers like Lockheed Martin, Walter Reed Medical Center, Clark Construction, and more. A new construction community, Amalyn by Toll Brothers, is coming soon and starting at $1,400,000. This means that prospective buyers for the area can look to renovated homes as a readily available and lower-priced alternative.

Property

This 1960s split-level home was a dime a dozen in this community, but the opportunity that this particular home offered was a lack of updates since the 1980s and a borderline hoarder situation. Most As-Is comparables showed more recent updates, particularly within the last 20 years. While the prime location means that all properties were held at a high valuation, our borrower found a unique opportunity to purchase below market value. The appraisal for this property As-Is came back at $860,000, but our borrower was able to purchase for $785,000 given the condition of the home created by borderline hoarder residents. This put them in an excellent position to stretch their profit margins on the project.

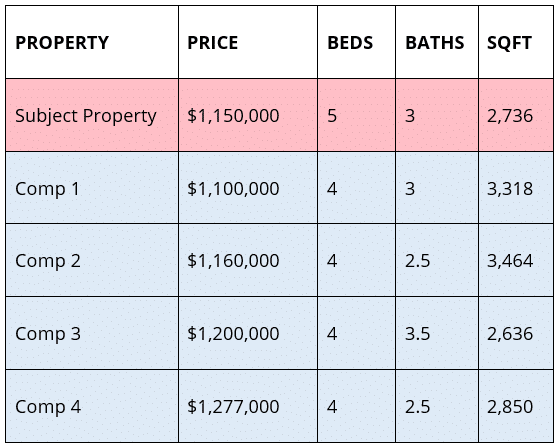

The As-Repaired comparables in the area are generally higher-end with a median sales price of $1,250,000 and the buyer demographics trending heavily toward high-paid executives and high-ranking government employees and contractors. After our borrower pulled comps, they set a strategy to land right in the middle of the sales prices for the closest comps with a resale price of $1,150,000.

Renovations

Because the property was not considered to be full-blown hoarder status, the renovations required would not include a full gut of the property, but rather demolishing some walls to open the floorplan while keeping many of the existing walls in the family room, bedrooms, and basement. The renovations were extensive in that none of the existing cabinets, appliances, and windows were viable to keep, yet most of the work for this project would really be considered cosmetic. The total renovation budget was $85,000 which was included in their loan.

Some of the notable renovations include demolishing walls surrounding the kitchen to create flow and increase its footprint, adding cabinet storage in the dining area, a glass-encased walk-in shower and freestanding tub in the primary bathroom, and an added bedroom in the basement.

Resale

When the property was listed in early October it had a pending offer after 48 hours and sold for $1,280,000 ($220,000 above the asking price) 27 days later. This provided a significant amount of additional profits on top of an already solid profit margin and our borrower was able to walk away from the project with an excellent payday.

After the Fix and Flip Loan was paid off and accounting for the interest payments, closings costs, and agent fees, we estimate that our borrower walked away from this project with an incredible 35-40% profit.