The pandemic-era hot market has finally cooled off in the majority of markets across the US – but there are other factors like the inventory shortage that are adding some interesting dynamics to the market. We may not be economists but we love digging into the data, so let’s take a look at what best practices make sense at the end of Q3 of 2022 given current trends and stats.

Indicators of Market Cooldowns

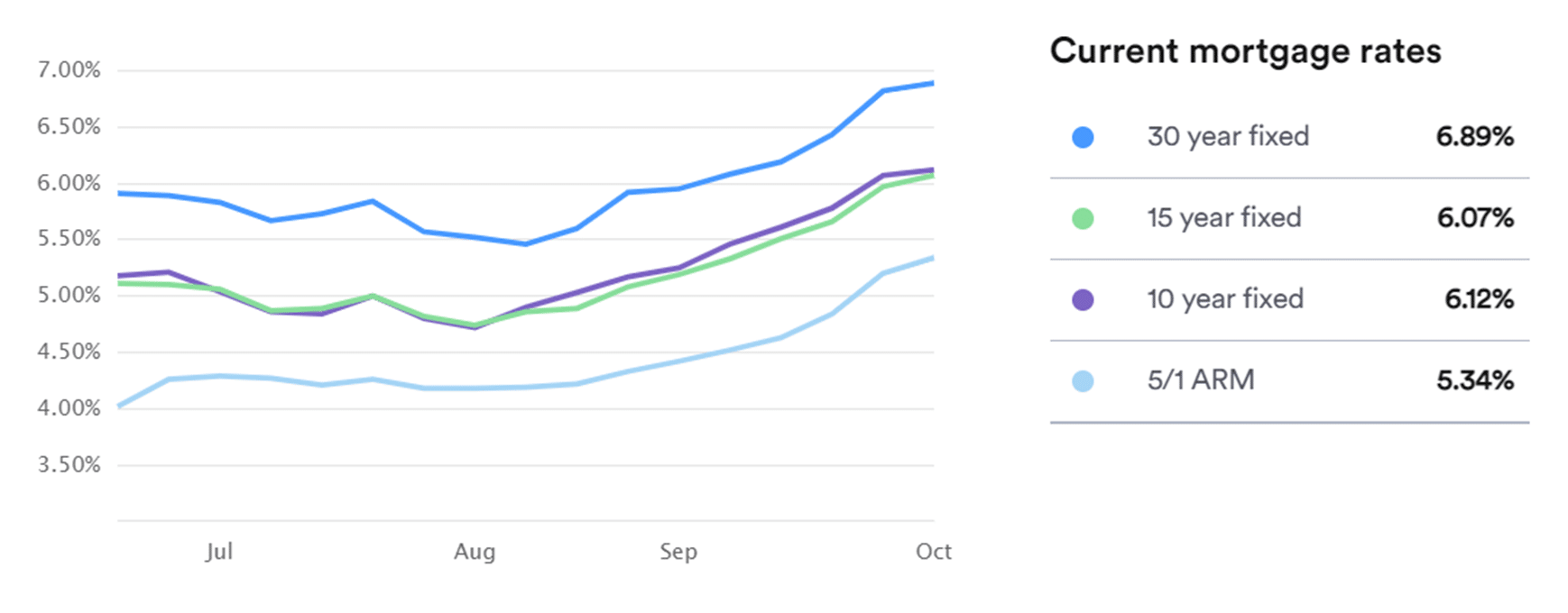

Interest Rates Are at a High

In September 2022, the Federal Reserve enacted another interest rate hike of 75 basis points in a continued effort to curb runaway inflation. According to Bankrate, the average interest rate for a 30-year home loan is 7.04% as of October 10, 2022. There’s no denying that rates a high compared to the great rates being offered at the beginning of the year, we are seeing a decrease in listing prices which simply means the rate hikes are starting to see their intended effect.

Anytime we see high interest rates, we always advise investors to consider which exit strategies make the most sense. Rentals may be a better play for you now, even if flipping was your focus over the last couple of years.

Price Reductions are Increasing, New Listings are Decreasing

According to Realtor.com, active listings nationwide in July were up by 28.7% year-over-year and newly listed homes were down 9.8% year-over-year, showing a significant drop in seller motivation in what has quickly become a buyer’s market. Realtor.com also shows that the price-reduced share of active listings is up 8.6% year-over-year, continuing to show the shift away from bidding wars and toward a bigger need to price homes to sell.

Key Takeaways for Investors

Wholesale deals are being sold at a discount. For the first time in years, we’re seeing wholesale deals sell at truly discounted prices. Wholesalers need to stay in business too, so when After Repair Values start declining, they know to respond with lower asking prices. If you’ve turned away from wholesale deals in the past due to their pricing, you may want to take another look.

Choose the Exit Strategy that is Best Supported by the Numbers. Anytime we see high interest rates, we always advise investors to consider which exit strategies make the most sense. Rentals may be a better play for you now, even if flipping was your focus over the last couple of years.

An inventory shortage could mean a hedge against the buyer’s market. Despite the Fed’s efforts to lower housing prices with higher interest rates, supply issues could present a more complex market. The byproduct of lower sales prices is a shrinking seller’s appetite, so we may see an inventory that would prevent prices from falling further. Stay tuned for future market updates to see how this one plays out!

Now more than ever, you need to master your micro-market. Despite the national trend of a cooling market, some cities have retained their high sales prices. Other cities have seen prices fall so drastically that properties that were prime candidates for flipping a year ago no longer make sense. If there was ever a time to double down on a smaller area that you know best, you’re probably looking at it.

It’s still a competitive investing landscape. Some investors may be playing it safe and sidelining themselves, but the smartest and best-prepared investors will be moving full-steam ahead. These are the folks who may have made a killing during the Great Recession while others were panicking or the ones who have been reading the tea leaves of this current recession and adjusting their buying strategies. The point is, well-prepared investors with plenty of capital are continuing to buy, so speed is still a necessity. We recommend continuously adjusting your deal analysis calculators, reading every article about shifts in your target market, and being prepared to move quickly when you find a deal that checks all of your boxes. Part of that equation is having your financing lined up, so if you need fast funding in today’s market, speak to one of our Loan Officers today.