Proactively Find Deals

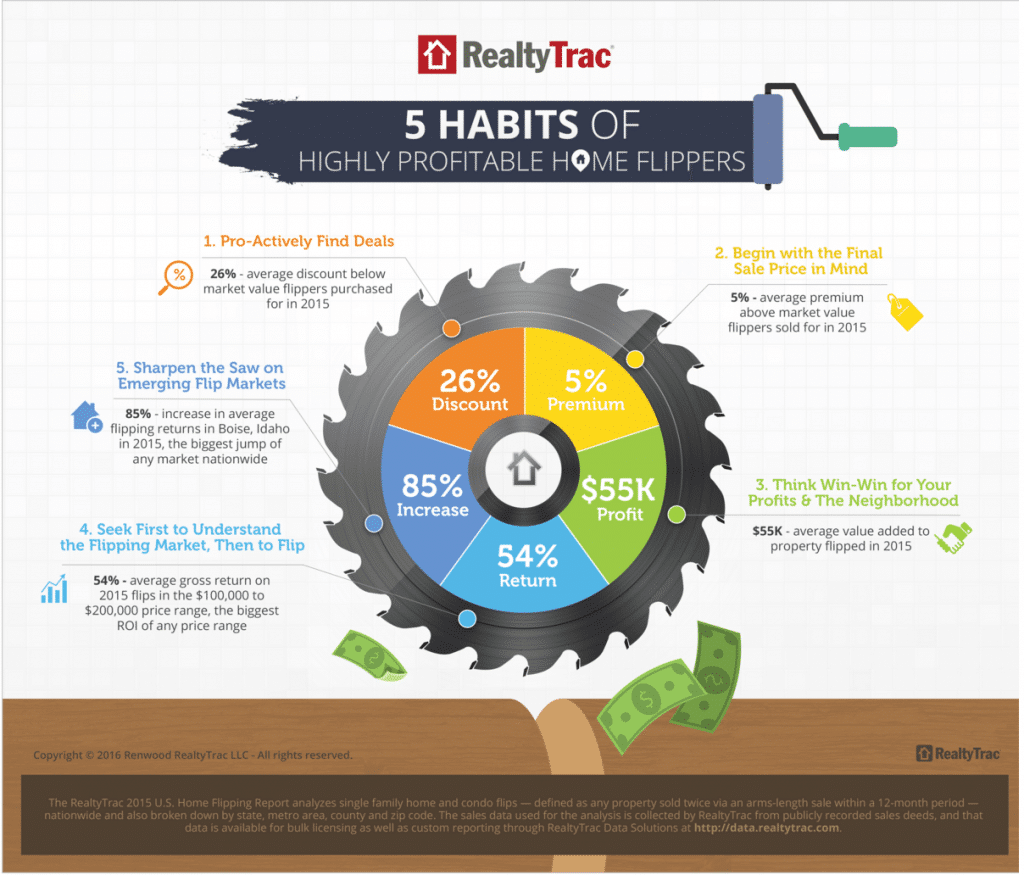

If you are proactive about finding good deals, you can substantially increase your profit margin. This includes keeping an eye on websites such as GreatDCDeals.com, reaching out to your network of investors, and even asking a lender for help finding a good property for below market value. According to RealtyTrac, in 2015, house flippers purchased homes at an average of 26 percent below market value.

In our market, on average, your property discount needs to be closer to 30 or 35 percent to make a profit from the flip. But this is where we can help you. We can give you the resources and assistance you need to proactively find the right deal in the right neighborhoods/counties. The current market, the area, and the process you’ll use to purchase the property will all determine the price. Learn more valuing your property here.

Begin with the Final Sale Price in Mind

In order to successfully flip a property, it is a good idea to have the home’s final sale price (After Repaired Value or ARV) in mind. Not only is this required by most hard money lenders in order to secure a loan, but knowing the price you want to sell your property for after you have rehabbed it will help you budget out the project. Last year, flippers sold their completed properties at a 5 percent average premium above market value.

In any market, a new property will always sell at a premium. However, in order to determine the ARV, you must look at comparable properties and their locations to establish an appropriate sale price. It’s important to understand that time is of the essence and you have to factor in your cost of capital. You want to have the better looking property and price it accordingly with the neighborhood. The market may surprise you with the premium prices. We have been doing this in the D.C. metro market for more than 11 years, and we are happy to help you with any questions you might have about pricing out the ARV of your property.

Think Win-Win for Your Profits & the Neighborhood

Last year, the average value added to a flipped property was $55,000 nationally. This includes everything from upgraded kitchens, appliances, flooring, paint to complete rebuilds. Not only does creating a quality property help your bottom line, but it can help boost the neighborhood as well. Neighborhoods with updated homes tend to be highly sought after, and that can even garner you competing offers for the property. At the same time, you want to keep with the general feel of the neighborhood. Model your rehabs after existing renovated properties to insure you will satisfy the demand in a particular neighborhood. Read more about the importance of knowing the neighborhood here.

Seek First to Understand the Flipping Market, Then to Flip

In 2015, the average national gross return on flips between $100,000 and $200,000, according to RealtyTrac, was 54 percent. Flipping a house can be very profitable, but you must know about the market and the process before you commit to such a large undertaking. Purchasing an investment property without a plan is one of the most lethal mistakes you can make. Make sure you know exactly what you’re getting into and what type of property that particular market desires.

In the D.C. metro area, this Return on Investment (ROI) is probably closer to 20 to 25 percent. Making a 54 percent return is difficult after you factor in settlement costs, real estate commissions, seller subsidies, etc. Keep in mind, this is neighborhood/product specific. If you are buying a rowhouse in Washington, D.C. and converting it to condos, your ROI is going to be significantly higher, as is your risk.

Sharpen the Saw on Emerging Flip Markets

House flipping has become more popular over the past few years, and new markets are starting to emerge. The biggest market jump in 2015 was in Boise, Idaho, where the average flipping returns increased by 85 percent. Other stable flipping markets include Washington, D.C., Prince George’s County, Maryland, and Philadelphia, Pennsylvania. As experts in the field, we can help you find property any of the local DC Metro area markets. Prince George’s County in Maryland (as mentioned above) has excellent opportunities for investors and home buyers. This county continues to be one of the nation’s newest and most promising markets.

Read the full report from RealtyTrac here.